Megacity Cluster Series Part 3: Greater Bay Area

In the third part of our series of articles on China’s megacities, we will today explore the Greater Bay Area.

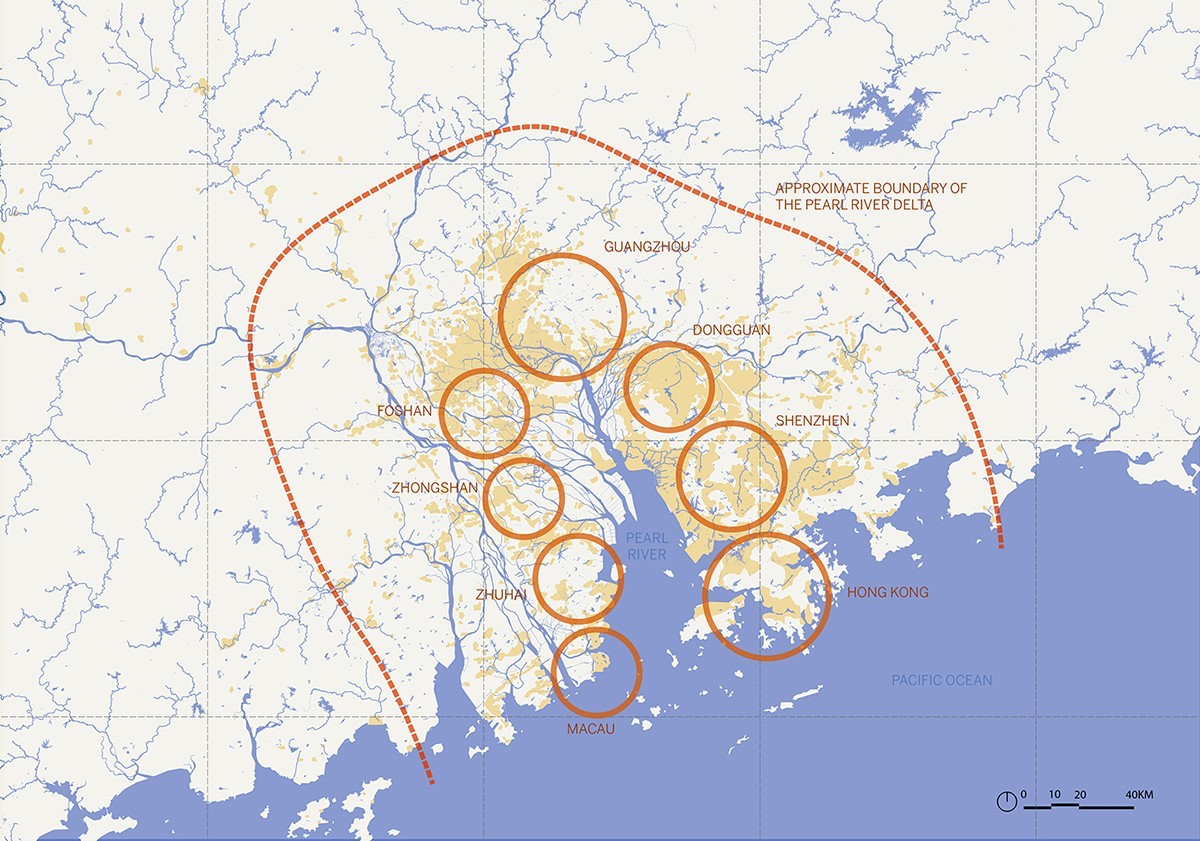

The Greater Bay Area, or GBA, is one of the three current megacity clusters in China. Located on China’s southern coast, it spans eleven cities: Hong Kong, Macau, Guangzhou, Shenzhen, Zhuhai, Foshan, Dongguan, Zhongshan, Jiangmen, Huizhou, and Zhaoqing. Previously known as the Pearl River Delta, this megacity concept was officially designated in 2016 in China’s 13th Five Year Plan to include Hong Kong and Macau.

The Greater Bay Area is home to 70 million people and an economy the size of Australia at 1.5 trillion USD in GDP (Source: Xinhua). At just 1% of China’s landmass and 5% of the population, the region comprises 12% of the national GDP (Source: CBRE).

The integration of these eleven cities into the GBA is designed to increase the scope of China’s already ambitious Belt and Road initiative. The inclusion of the Special Administrative Regions of Hong Kong and Macau sets the region apart from other megacity clusters in China, as they provide a gateway for global investment and increased internationalization. Seeking to establish a rival to the Silicon Valley in the South of China, the GBA is set to become the global launchpad for China’s rapidly developing high-technology sector.

Source: 1421 Consulting

History of the region

China’s economic liberalization began in 1978 with Deng Xiaoping’s Reform and Opening Up policy. A year later, the Chinese government announced that Guangdong province would be the site of three special economic zones, with Shenzhen and Zhuhai being among them, setting the course for the development of multiple economic powerhouses in China’s Pearl River Delta. Since then, the capital of the province, Guangzhou has developed into the manufacturing and logistics capital of China, and Shenzhen has developed into the financial and technological capital of China.

The Special Administrative Regions of Hong Kong and Macau are former European colonies with their own monetary systems and governance. Returned to China before the turn of the millennium, both cities have long been incorporated into the global capitalist market economy and operate with relative autonomy from the mainland under the Chinese government’s One Country Two Systems model. Wealth from Hong Kong, one of the Four Asian Tigers, has been a driving force in neighbouring Shenzhen’s rapid growth since the latter’s designation as a special economic zone.

Development plans of the region

The Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area is the official name of the master plan for the development plans of the region. Announced in 2019, the master plan’s goal is to transform GBA into a world-class bay area economy rivalling the New York, San Francisco, and Tokyo bay area economies by 2035 with an emphasis on sustainable innovation.

The GBA’s eleven cities contribute to the megalopolis their complementary strengths:

– Hong Kong connects the GBA to the rest of the world through its common law jurisdiction and business-friendly policies. It is a world financial centre, ranked sixth globally according to the Global Financial Centres Index 2020.

– Macau is a prime international destination for leisure and tourism, boasting the largest casino and gambling industry in the world. As a former Portuguese colony, Macau serves as a connection to Lusophone economies such as Brazil and Portugal.

– Guangzhou serves as the manufacturing and logistics hub of not only the GBA but all of China.

– Shenzhen is the home of China’s leading tech companies such as Tencent and Huawei. It has one of the world’s highest investment in R&D at 4% of its GDP in 2018 (Source: SCMP).

– Zhuhai provides the GBA with another destination for tourists, is known for its golf courses and theme parks. It is also a strong manufacturing hub in its own right.

– Jiangmen serves as a river port for the GBA.

– Dongguan and Foshan serve as production hubs for the GBA.

– Zhongshan, Huizhou, and Zhaoqing serve as reservoirs of surplus labour for the GBA, with low rent and cost of living.

Infrastructure

Infrastructure sits at the core of regional economic development plans. The GBA already contains three of the world’s top ten container ports (the Port of Hong Kong, the Port of Guangzhou, and the Port of Shenzhen) (Source: SCMP) and three world-class airports accounting for 13% of global air freight transport (Hong Kong International Airport, Shenzhen Bao’an International Airport, and Guangzhou Baiyun Airport) (Source: SCMP), in addition to extensive high-speed rail for intercity transit and highly urbanised metro systems for intracity transit.

There are a few key infrastructure projects aimed at more comprehensively integrating the constituent cities of the region:

Hong Kong-Zhuhai-Macau Bridge (HZMB)

Completed in 2018, the Hong Kong-Zhuhai-Macau Bridge was constructed to connect Hong Kong to the western cities of the Greater Bay Area. At 55km, with 7km tunnelled underwater to circumvent shipping routes, it is the largest sea-crossing bridge in the world. The HZMB brings Hong Kong within a three-hour commute to the entire western side of the GBA bay (Source: BayArea.gov). Since construction, the bridge has brought Macau a 25% year on year increase in tourist arrivals (Source: SCMP).

Express Rail Link (XRL)

Opened in 2018, the XRL provides Hong Kong with direct rail service to 58 mainland cities. Notably, the high-speed rail of the XRL considerably shortens travel times between Hong Kong to Shenzhen (18 minutes) and Guangzhou (46 minutes) (Source: BayArea.gov).

Shenzhen-Zhongshan Corridor

Completing construction in 2024, the Shenzhen-Zhongshan corridor will be a 24km long infrastructure cluster including an oversea bridge, a subsea tunnel, artificial islands, and an underground interchange. It will significantly cut down the travel time between Shenzhen and Zhongshan from two hours to 20 minutes, connecting Shenzhen to the western bay of the Bay Area (source: BayArea.gov).

Sectors

The major industries in the GBA are manufacturing exports, technology development, fintech, and real estate. Of the companies in the 2019 Fortune 500 list, 20 are based in the GBA, including Tencent, Huawei, Ping An Insurance, and China Resources.

Source: cnbayarea.org.cn

Owing to its history as the region with the first special economic zones, the GBA region’s mainland cities also have a smaller share of SOE, state-owned enterprises, than the rest of China. The share of SOEs is 21.2% in the region compared to the national average of 35.7%, reflecting a more private-enterprise oriented economic development than the state-initiative led development in the rest of China (Source: EY).

Challenges

However, the GBA also faces several hurdles to integration, owing to the inclusion of the two SARs. With Macau, Hong Kong, and the mainland operating under different governance structures, there will be considerable hurdles in facilitating the free flow of people through three different legal and economic systems. As the coronavirus limits the flow of people between SAR cities and the mainland in 2020, the economic development of the Greater Bay Area is facing a slowdown and big challenges.

What business opportunities does the GBA hold for foreign companies?

As the only megacity including SAR cities, the GBA presents a major attraction for foreign companies. The integration of GBA’s mainland and SAR cities will allow foreign businesses to onshore with direct access to the domestic consumer base and take advantage of stronger intellectual property services in the SARs. On the policy level, the GBA will boast preferential individual income tax policy for overseas talents (source: China Briefing) as well as foreign investment laws that remove bureaucracy to set up a foreign-invested enterprise in China (Source: China Daily).

Click on the links below to know more about our series of megacity cluster in China,

– Megacity Cluster Series Part 1: Jing-Jin-Ji

– Megacity Cluster Series Part 2: Yangtze River Delta

How Melchers supports foreign companies in China

With 155 years of business experience in various sectors in China, we know that every company needs its unique approach to the Chinese market. China’s business world is constantly changing and varies greatly from region to region in terms of prosperity, regulation, openness to business, and other factors influencing the business environment. Due to its size and diversity, China can hardly be compared to any other country in the world. To successfully master the regional differences, small and medium-sized companies need to have an experienced partner like Melchers in China. With locations in the most important economic centers in Greater China, we have a regional and holistic understanding of the Chinese market and can tailor your market strategy ideally to individual regions. By utilizing our expertise from many years of cooperation with numerous national and international companies in China, we can offer comprehensive services along the entire value chain and make your business in China a success.

To learn more, please contact us at marketing@bj.melchers.com.cn.