Up in the sky. Interview with Melchers on opportunities in the Chinese aviation market

Interview with Mike Hofmann, Managing Director of Melchers China in Beijing, a service provider and brand partner in China.

- Could you provide some background into the experience Melchers has in the aviation and machinery sectors?

In general, selling machinery and industrial materials to China is one of the core pillars of Melchers’ business. We began systematically selling machines to China in 1968. During the past 50 years, our portfolio continuously adapted to the needs of the Chinese economy. Today we serve customers in 15 industries such as automotive, pharmaceutical, packaging, and aviation industry.

The aviation business of our company relates to 1974 when the company Aviation Technical Services (ATS) was founded in Singapore. In 2004, Melchers acquired the company and created the Melchers Aviation Technical Services (MATS) business unit, active in Greater China, Singapore, and the Philippines. Our business mainly focuses on two segments within the industry: cabin interior products and tools and machines for Maintenance, Repair, and Overhaul of aircraft (MRO).

- Recently, Melchers has entered into two new partnerships with ANKER and Iacobucci HF Aerospace. What will these partnerships entail?

We are proud to partner with these two distinguished brands. Anker is from Germany, and Iacobucci is from Italy, and while they are both in the interior cabin business, they are in different segments.

Anker is also a long-standing business founded in 1854 and shares the values of Melchers. They are specialists in woolen and nylon carpets used in airplanes and have been selling their carpets into the aviation industry worldwide since the 1960s. Although they already had some first accounts in China, we are helping them grow their China business as their sales agency in the country from the beginning of this year. We will be operating the entire sales, after-sales, and technical consultation processes. Anker’s customers are mainly airlines and lessors.

Iacobucci is an Italian company that develops and produces galley inserts, trolleys, and seats for the aviation industry. Products that they specialize in include Coffee Makers, Water heaters, Trash compactors, Cooking stations, etc. Melchers has become the exclusive agency in China and will be managing the sales and after-sales processes and technical consultations. For Iacobucci, customers are both airlines and MRO companies, who refurbish and repair the aircraft.

- How Is Melchers China able to assist the new partners with expanding their businesses in the China market?

As I mentioned, we purchased ATS in 2004, and the company was active in aviation since 1974. We have developed and maintained a strong customer network that we can rely on and bring to any partnership in the industry. The aviation industry is relatively closed and small compared to other industries we are active in terms of customer base. There are only a limited number of airlines and aircraft suppliers. If you do not have the right contacts, getting into the market can be very difficult. We have sales teams in different cities in China and can cover much ground. Our team included technicians trained to handle and consult on technical components of the products of our brand partner. It is essential to know the customers in China and be on their purchase lists, which we can help companies with.

It is essential to mention that China is building up its aircraft, which will start delivery this year. We are on the ground and are optimally positioned to get the companies through the certification processes as early as possible.

- Are there differences when comparing how providers within these industries conduct their business outside of China and within China?

The aviation industry is global, which means that a lot of the negotiations are conducted in English. Nonetheless, not everyone speaks English in China. Often, it is only the key contact person, and if you dig deeper, the language and culture barriers will still exist.

In order to sell into the aviation industry, the company must be listed and approved by either the aircraft manufacturers, for example, Boeing and Airbus, or by different authorities. In China, this is the Civil Aviation Administration of China (CAAC). Once the company has the approval, it can begin to sell, but without it, selling is impossible as it means the company is not certified. Because of this, the minimum requirements are not very different within and outside of China, and companies can expect that all their competitors will meet these requirements.

For other processes, they are also quite similar. The sales circles are extended, with product deliveries taking up to 4-5 years. The situation is a little different for the MRO business because aircraft tools and machinery do not require as much planning ahead, which makes the processes shorter.

In general, we hear from our suppliers in Europe that Chinese customers often want to know more details than the significant Western customers when it comes to technical questions. On top, they are highly risk-averse, so they want everything officialized. As a result, Chinese customers tend to shy away from being a pilot or test case for new product development.

- What are the main risks and investments that companies in the aviation sector need to be aware of for the China market, outside of the listings and registrations?

In China, airlines are highly risk-averse and do not want to be the first to try something out. They are apprehensive about products not working or being unsafe, so they only want proven concepts. This means that if a company has a new innovative product, it is better tested in the Western aviation sector because Chinese airlines will seldom accept it. However, the good thing with this mentality is that in China, you do not have copycat products of technical aviation products because customers will only want to buy from the original manufacturers. Unlike other industries we are in, the aviation industry is a role model in that regard.

In the long term, China wants to develop its aviation industry and suppliers. To do so, China is purchasing overseas companies in order to obtain the required technology and invest in R&D. Hence, there will likely be more competitors in the future, along with the risk of technology transfer.

- In terms of competitors, who are they? Are they primarily foreign or domestic?

With the airline listings, companies can know exactly who the competitors are. For outfitting Airbus and Boeing aircraft, most competitors are foreign, with a few local companies. As mentioned, Chinese companies merge with and acquire foreign suppliers, which they want to develop their industry further. Their capability in some sectors is already on par with foreign technology.

Overall, the companies that we partner with are often very niche, with only a few suppliers for one type of product. Anker is a good example, selling nylon carpets in China. They are really in demand due to their cost-saving and weight advantages, and there are no other competitors for this particular product material in the market yet. Another example is for our interior business, we work with the company Innovint from Germany that produces baby bassinets. They are a listed supplier and preferred company due to their qualitative products. Their products are specialized to be very light and durable, able to withstand the forces of an aircraft that is constantly changing its frame from moving through the air. Even in our MRO segment, nearly all of it is imported for the repair tools and machinery required.

Chinese companies are catching up, but in these niche segments we serve, our competitors are mainly foreign, not domestic.

- How can a company understand whether it is doing well in the China market?

The state airline companies publish their plans on how many aircraft they want to purchase regularly, making it easy for companies to calculate their market share. Companies can also improve their performance by increasing their service level on the ground, which could be a point of differentiation.

- With the lockdowns and travel restrictions due to COVID-19, how has this impacted the aviation and machinery industries?

The aviation industry was very badly hit. Retail is recovering, but aviation experts say it will take 4-5 years for the industry to reach 2019 levels again.

However, domestic travel in China is recovering and ahead of Europe by far. In the MRO segment, our business has picked up again in the second half of last year. However, the airlines are still suffering because the planes are not complete, and the overseas routes are not fully open. In China, there are rumors about airline mergers that might happen.

In the past, since the aviation industry is so tiny and only has a handful of airlines, it was pretty convenient for overseas manufacturers to fly into China once a quarter, visit them and then fly back to their home country. Because they could do this, it meant they did not necessarily need an agent in China. With COVID-19, this changed. Melchers was able to step in and help companies provide better local support to their customers. We had several talks with aviation suppliers who changed their China strategy as a result of COVID-19.

Another critical point to make is that cost-saving advantages that companies might have compared to competitors are becoming more critical, primarily because of how much the aviation industry has seen a downturn due to the pandemic. As an example, for Anker, we have focused on the nylon carpets in China because the technology is very high, with material that is much lighter and more durable. Both of these factors lead to cost savings.

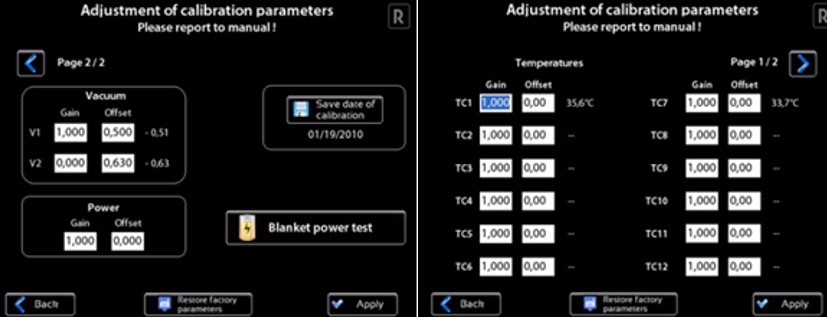

In some ways, the digital tools available have helped in our business processes. The ability and willingness to conduct training have improved. In the past, our brand partner came to China once a year to provide a training session, but now the training can be conducted more frequently online. For some machines, remote control or calibration is available, so I would say the pandemic has slightly helped digitize the industry. We will see after the travel restrictions are over whether these changes are here to stay.

- Although some of the calibrations can be done online, for calibrations that cannot be, how have companies been able to tackle this issue, especially as they cannot fly in overseas experts due to the travel restrictions?

One of Melchers’ value propositions is to bring suppliers, technicians, and partners together. Within our team, we have trained technicians who can be further trained to fix machines on the ground. Because of this, I think it has become clear over the past year why partnering with agencies like Melchers brings value to companies in the aviation sector. Instead of shipping products and machines back and forth, Melchers can be on the ground and shorten the process. Time is money, particularly in the aviation industry. To address the local demand and increase the service level in the market, we have opened a calibration laboratory in Shanghai in May 2021 together with our brand partner GMI Aero. This is a perfect example of how Melchers can provide value to both – the brand partner and customers.

- What are general trends within the Chinese aviation industry to watch out for in the next five years?

The following 4-5 years will be the recovery phase, as the aviation industry slowly grows to reach 2019 levels again. We hope that many companies will survive, but the reality is that many will struggle or get taken over, and there will be structural changes in the industry.

This year, one change is that the Chinese aircraft manufacturer will be delivering their Comac C919 to China Eastern. After that, the Chinese will have their own aircraft and need more suppliers, creating a new market and is an opportunity that companies can take advantage of. Chinese manufacturers will begin to emerge through mergers, acquisitions, and outside purchasing, increasing competition. New programs such as the C929 are already well under-away. Suppose a supplier wants to be relevant to the Chinese developers but is locked out of China at the moment due to the pandemic. In that case, we seriously should consider partnering up with a well-connected company like Melchers to not miss out on future opportunities.