Lessons learned from 2020, and where to go in 2021?

2020 saw the world in crisis mode. The COVID-19 crisis threw the global economic system’s delicate balance off-kilter, impacting everything from how we manage our personal lives to how we work. This paradigm shift has since been dubbed “the new normal”.

From global supply chain disruptions and closing of brick-and-mortar businesses to the mass layoffs in the hospitality industry to the strict stay-at-home orders, the effects of the COVID-19 have been far-ranging and diverse. These have all affected each business’s capacity to operate and the people’s accessibility to work and earn an income, and in effect, make purchases to keep micro and macro economies of scale flowing properly. Depending on these businesses’ nature, some have flourished by retaining productivity despite work from home policies, while others have had to pivot their business models.

Moving into the 2021 Post-COVID economy

Digitalization Accelerated

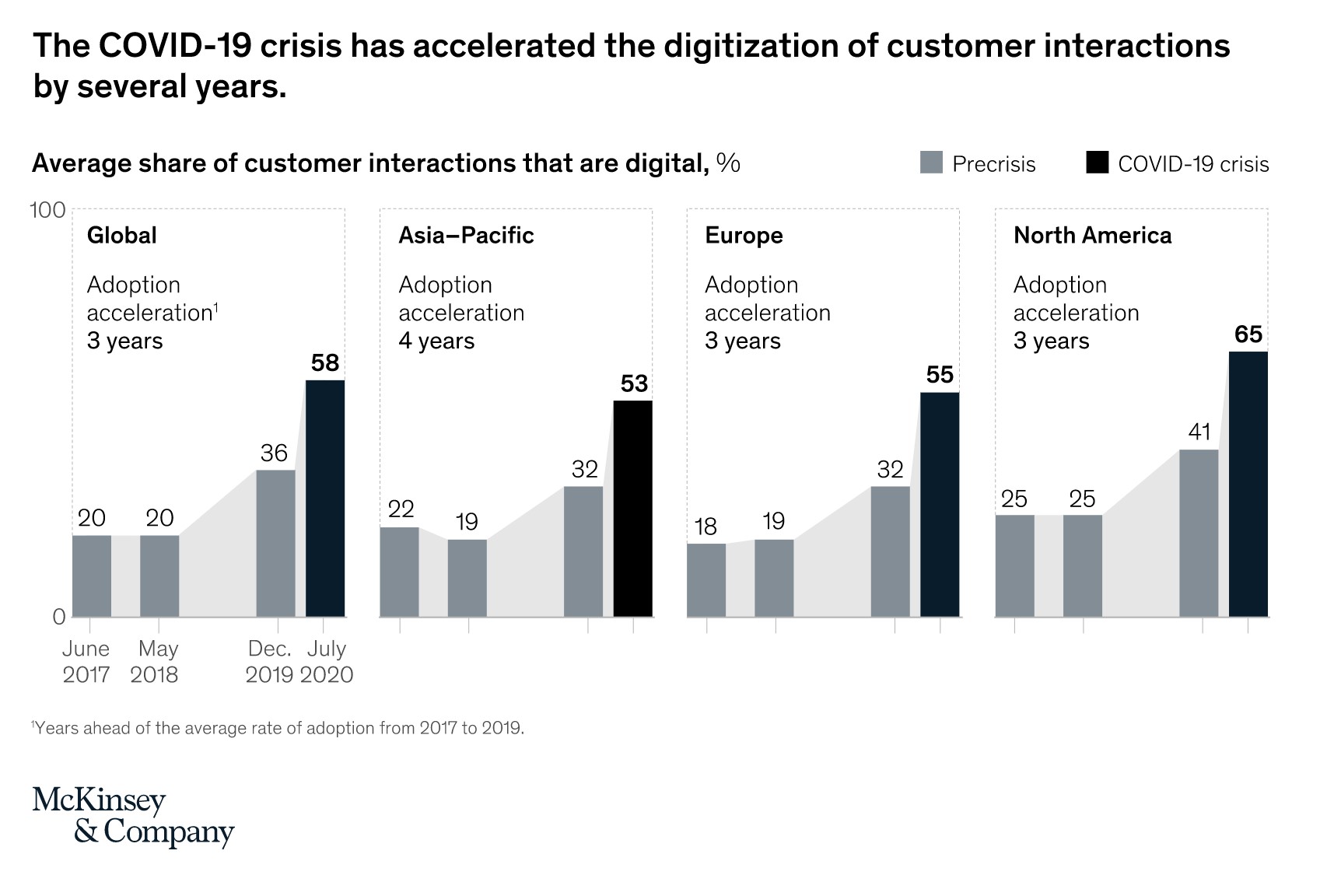

While most companies were already moving towards digitalization in 2019, the COVID-19 outbreak forced everyone to accelerate this process. Unable to travel and with limited options to leave the house, consumers had to move their shopping online. According to studies from McKinsey & Company, the crisis has sharply increased the trend of customer interaction digitalization all across the world.

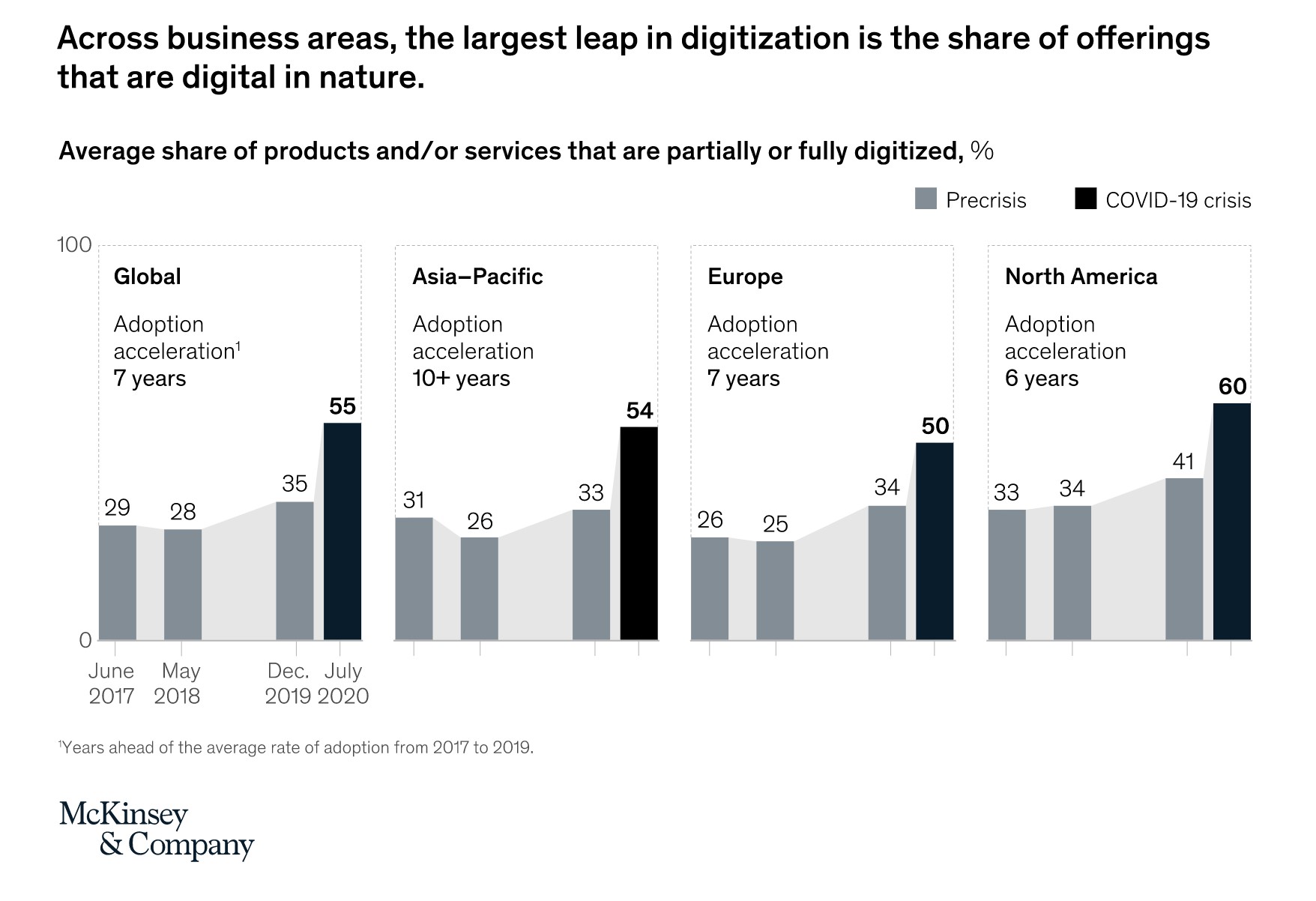

According to the same McKinsey study, following the digitalization of consumer interactions, the number of digital products and services have also sharply increased globally since the COVID-19 crisis.

This trend is unlikely to reverse course, even as the COVID-19 crisis winds down with vaccinations. Consumers have gotten used to the convenience of buying online while businesses have invested in optimizing their e-commerce channels during the crisis.

Strategic Transformations

In response to the widespread digitalization of business, new marketing models have emerged in tandem, such as livestreaming product showcases, omnichannel retail, and social media-driven e-commerce. On the ground, in response to the slowdown in global supply chains, businesses have started diversifying and localizing their supply chains to mitigate risks of slowed down freight transport due to closed borders

In China, where the economy has already bounced back – even the hard-hit hospitality industry has registered year-on-year growth – we can see how many of these changes have taken hold. Ecommerce has shown no signs of slowing down, as major e-commerce tech giants report increasing gains in growth and increasing digitalization, despite stay-at-home directives becoming a distant memory. As borders are still not fully open to foreigners, there has been a shift to businesses targeting local/domestic clientele, as seen in industries ranging from tourism to luxury.

In the US, where the crisis is only finally being controlled, stimulus checks have changed retailers’ economic landscape. Middle-class consumers who do not need the stimulus check to cover living expenses now have extra disposable income to spend on luxuries. This should influence American business supply chain management and product pricing strategies to avoid situations like the computer graphics card shortage we are facing now.

Cash Flow is King

With 2020 being the year of the pivot, we have seen large scale strategic transformations across industries. However, a company cannot change everything without affecting its balance sheet. During a period of turbulence, a powerful force comes to the fore: cash flow.

The global economy has seen consistently positive growth every year since the economic crisis in 2008, and that growth has spurned a sense of the “good times are here to last,” and companies made decisions based on this growth. While this year has a seen a spike in the rate of people saving money, businesses are seeing their cash flows and savings evaporate at rapid speeds. Without customers, there is no income to pay their staff, pay for rent, mortgages, loans, utilities, supplies, and other business expenses. That pool of cash can run dry quickly, and the good times led to a period of businesses overstretching themselves.

Sometimes second-guessing a significant purchase today is beneficial for the sake of tomorrow. 2020 has proved that having a healthy rainy-day fund on top of a smart cash flow will be a lifesaver for a business in 2021 and could provide an opportunity to grow as the year turns into a new one.

Into an Uncertain Future

Suppose your company pivoted well, and you had enough cash to ride the storm, but what about next year? What happens if a new wave occurs or an economic downturn hits? How do you mitigate this looming risk?

While Q3 and Q4 of 2020 were a giant push to regain some lost business from the previous two quarters, there has been a chillier response towards the end of 2020. This can be attributed to the usual slow down in the run-up to the Chinese New Year in early 2021 and an uneasiness of not knowing what will happen next year in terms of COVID-19 and the opening of national borders. However, this does not mean decisions should not be made, as it is the beginning of a new quarter and a new year, and these decisions reflect the first three months of 2021 with the hope of building momentum for the rest of the year to ride on.

Hedging Your Bets into 2021

Congratulations if your business made it through 2020. The coming new quarter will bring new surprises but also hopefully a sense of normalcy as the crisis is controlled. As you strategize for the next quarter of 2021, keep in mind the lessons learned from 2020.

We have seen that digitalization is here to stay, and the COVID-19 crisis has only accelerated a preexisting trend. Keeping on top of changes to the landscape of e-commerce and digital marketing will be key to maintaining a competitive edge, as this fast-paced arena is likely where the next opportunity for your business will be found.

With the slow opening of borders, it will make sense to keep a strong focus on supply chain management for your products and look for potential bottlenecks – diversifying supply chains will be a lifesaver for your business in the event of a new crisis, even if that means losing out on small cost savings.

On the other hand, diversifying your client base will also safeguard your business from large scale disruptions – especially if your main clients are overseas. Developing strong local client loyalty through establishing a strong local reputation can help you weather out an international crisis such as this one.

And finally, do not take anything for granted, especially good economic conditions. Always keep emergency savings on hand to help your business pivot strategically.

How Melchers supports you in China

With 155 years of business experience in various sectors in China, we know that every company needs its unique approach to the Chinese market. China’s business world is continually changing and varies significantly from region to region in terms of prosperity, regulation, openness to business, and other factors influencing the business environment. Due to its size and diversity, China can hardly be compared to any other country in the world. To successfully master the regional differences, small and medium-sized companies need to have an experienced partner like Melchers in China. With locations in the most important economic centers in Greater China, we have a regional and holistic understanding of the Chinese market and can tailor your market strategy ideally to individual regions. By utilizing our expertise from many years of cooperation with numerous national and international companies in China, we can offer comprehensive services along the entire value chain and make your business in China a success.

To learn more, please contact us at marketing@bj.melchers.com.cn.