Retail Technology in China: Latest Trends and Applications

Source: Daxueconsulting.com

In the last decade, China has begun shifting from a manufacturing-based economy to a service-based economy. With the rapid growth in the wealth of the middle class and government investment in technological development, retail technology in China has evolved at a breakneck pace. A defining feature of China’s retail infrastructure is the widespread adoption of mobile payments, at 86% penetration in 2019 (source: PwC), which have enabled the unhindered rise of e-commerce and technologically integrated retail strategies.

The coronavirus outbreak that first swept through China at the beginning of 2020 has already left a lasting impact on how retailers do business. Most notably, China’s burgeoning e-commerce infrastructure has emerged from this stress test stronger than ever, with proof of its necessity laid bare.

Below, we list three of the latest trends of applications of retail technology in China:

Importance of omnichannel retail/O2O/new retail is becoming evident

Omni-channel retail, O2O, and new retail all refer to the same concept: there is growing acknowledgment by retailers that offline and online retail are complementary, not zero-sum. This means providing customers the experience of buying products in whichever channel they want, seamlessly integrating consumer experience between various online platforms and offline brick and mortars. The end goal is to have users not perceive the sales channel, but rather smoothly flow through multiple channels for their purchases.

With so many new and emerging e-commerce platforms, Chinese brands are expanding their presence over multiple platforms to take advantage of flexible and customized market strategies to capture market opportunity both online and offline.

The most successful recent example of omnichannel retail is the rise in app-delivered grocery services, notably Alibaba’s Hema grocery and JD.com’s 7Fresh (both of which operate as brick and mortar grocery stores with online apps for shopping and delivery). These services proved invaluable during the outbreak for feeding everyone quarantined at home. The outbreak of coronavirus had a significant impact on the retail sector in China in the first quarter of 2020; however, online sales of grocery and foodstuffs grew by 33 percent during the outbreak (Source: internetretailing.net).

Hema and 7Fresh brick and mortar stores are examples of automatic retailing, being outfitted with unmanned checkout kiosks, mobile-scanned product details, fast-running fulfillment conveyor belts. Customers can make their purchases via mobile payment and expect their groceries at their front door within 30 minutes. On the online side, the Hema and 7Fresh apps allow consumers to order their groceries online while door-to-door delivery of the goods is dispatched within the hour. Furthermore, the apps are equipped with well-developed AI technology that utilizes data harvesting from the apps to inform stocking and retargeting.

Source: Thatsmag (Hema App and Hema brick and mortar store)

Even automobile sales have taken on omnichannel retail practices in China. Ford’s automobile vending machine allows customers to browse for models on the Ford app, then test drive cars by scanning barcodes at a vending lot, providing up to three days of test driving. If they’re interested in purchasing a car, they can contact a Ford dealership.

Source: CMO by Adobe

According to Gartner, 82 percent of Chinese luxury consumers already use a combination of online and offline channels to make purchases. Seeing the fast-paced adoption of omnichannel retail technology in Asia, John Donahue, Nike’s CEO believes that omnichannel will soon be the new normal globally: “‘blended digital versus physical experience’ is a thing of the past. Consumers don’t think in those terms… What we’re seeing in Japan, China, and Korea is that seamless digital-physical experience is responding to what consumers want.”

Virtual shopping is the next step for e-commerce

With the coronavirus outbreak erupting first in China, Chinese retailers were one of the first to adopt virtual shopping trends.

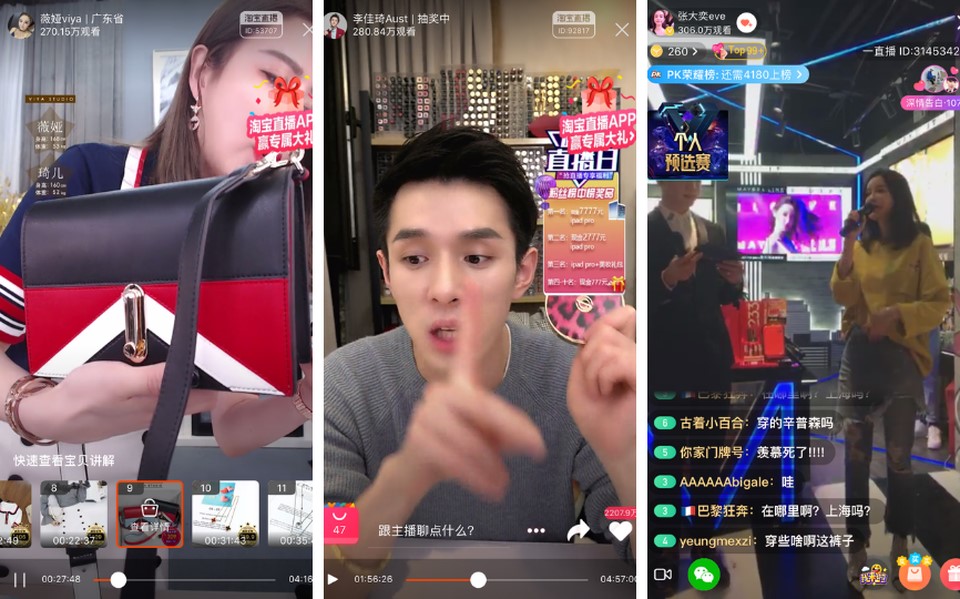

Livestreaming e-commerce will become an increasingly important online sales medium as it has infiltrated most major brands’ online retail strategies since the COVID 19 outbreak. We’ve covered how T-mall had partnered up with Shanghai Fashion Week for a livestreamed fashion show. Taobao’s livestreaming platform experienced a seven-fold surge in first-time business customers in February 2020 while Pinduoduo’s livestream sessions saw a fivefold increase (Source: Washington Post). Livestreamed product presentations provide a more immersive e-commerce shopping experience.

In China, the livestream product presentations aren’t just infomercials. Rather, they include entertaining side notes from hosts, education on how to use the product, and with live-commenting, interaction with potential customers live on-air. On Taobao, hosts present a range of products from different brands, showing details and explaining, removing the anxieties many customers would have of buying fake products online.

Source: Forbes

While a promising trend a few years back, VR has failed to see the same breakthroughs for Chinese retail adoption as technologies such as livestreamed e-commerce. However, buoyed by the strict quarantine measures in China, VR is now finally making a comeback as a retail technology. In February of this year, Lanvin partnered with the Chinese video platform iQiyi to bring their Fall/Autumn 2020 catwalk show to viewers at home through VR technology. Livestreamed on Chinese luxury e-commerce platform Secco, the show was hosted by Parisian-based Chinese KOL.

Source: JingDaily

The accelerated digitalization of the Chinese market, boosted by massive mobile adoption and the coronavirus outbreak in 2020, has successfully created a market opening for a variety of technologically enhanced e-commerce retail strategies that will only get more innovative.

5G will enhance AI-assisted retail

Over the last few years, AI has become a centerpiece for retail technology development. With e-commerce heavyweights like Alibaba and JD.com comprehensively investing in a range of AI technology, Chinese AI retail technology has moved at lightning pace. According to the AI in China 2020 Whitepaper by Daxue Consulting, China ranks first in the world when it comes to the scale of investments in AI technology.

We have already seen widespread adoption of AI-assisted technology in place in China for the last few years, whether it be facial recognition payments, voice recognition systems for customer service bots, drone delivery services, or augmented reality beauty counters.

KFCs in China now deploy AI facial recognition for not only payments but for predicting customer choices. Developed in partnership with Baidu, China’s answer to Google, KFC’s facial recognition software can scan customers faces and recall their previous orders. Also, through facial recognition, it harvests data to create customized menus based on location and age.

MarieDelgar, a Chinese cosmetics and beauty company, has rolled out unmanned beauty shops across the country. Combining self-service vending machines, shopping guider robots, AR virtual makeup, and QR codes payments, these shops can collect consumer information and make personalized product recommendations for consumers without the need for employees.

Source: ChinaDaily HK

Beyond the technology that directly interacts with customers, AI has become the backbone of retail management and logistics systems. Large retail chains with hundreds of physical stores across the country have started deploying AI-assisted systems to manage their complex retail networks. Dahua, a Chinese video surveillance company, has moved into the smart retail technology field. It provides AI-driven data collection and visualization tools for managing stock, remote patrol for monitoring the real-time performance of stores, and facial recognition technology to track customer preferences and store traffic.

As many innovative AI-assisted retail technologies operate through the Internet of Things (IoT), the shift to 5G infrastructure greatly enhances the scope of what these retail technologies will be capable of.

For example, Fung Retailing, Hong Kong-based consumer goods supply chain group, has partnered with JD.com to launch the first 5G enhanced AI checkout service at a physical retail store. According to Sabrina Fung, the managing director of Fung Retailing, they wish to “prototype a process to shorten checkout time to 4.5 seconds. When you walk into the store, as soon as it recognises you, that is the payment mechanism.”

How Melchers supports foreign companies in China

To profit from the great potential of the Chinese consumer market, it makes particular sense to look beyond the large, developed cities and turn to emerging regions. However, these cities and regions are mostly unknown to foreign companies. In addition, the demands of local consumers on products and their marketing differ greatly from those in Tier 1 cities. Thus, there is a risk that companies with little experience in China will miss the new Chinese consumption growth wave.

Melchers can help foreign companies to develop and roll out their own China strategy. We have been active in China business for 155 years and maintain offices in 18 Chinese locations. As a result, we have a strong national and local presence and understand the individual needs of consumers across China. We help our brand partners to understand the Chinese retail market, correctly assess the market size and competitive situation and identify short, medium, and long-term opportunities for growth. In doing so, we can assume the entire retail function of our brand partners.

To learn more about our services, please contact us at marketing@bj.melchers.com.cn.